Us hourly wage tax calculator

Federal tax State tax medicare as well as social security tax allowances are all taken into account and are kept up to date with 202223 rates. Calculating an Hourly salary from an Annual revenue.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

We developed a living wage calculator to estimate the cost of living in your community or region based on typical expenses.

. Based on a 40 hours work-week your hourly rate will be 1645 with your 45000 salary. These figures are pre-tax and based on working 40 hours per week for 52 weeks of the year with no overtime. Cost of Living Calculator.

When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. So take the hourly wage add a zero behind it and then multiply that number by 8 to get your pre-tax biweekly income. Our calculator also allows options such as salary.

The minimum wage is set at a provincial level so discrepancies exist in Canada. Cost of Living Calculator. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay.

If your stated work week is 5 8-hour days but your boss also has you come in on most Saturdays then you could calculate your work week as having 6 days to calculate what the true hourly earnings are. Take for example a minimum wage worker in 2022 that works 36. US Salary Tax Calculator.

X hourly wages Annual Salary. Sales Tax States to calculate sales tax of US States city and zip code. 147000 any salary above this amount is exempt.

Net weekly income Hours of work per week Net hourly wage. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Employers are responsible for paying 6 of each employees first 7000 of taxable.

Calculate Sales tax US. US Income Tax Calculator 2022. 120 per day 8 hours 15 per hour.

We also have an option to include the Married Couples Allowance if you are married and one of you have been born before the 6th of April 1935 you can tick the I am married and one of us was born before 6th April 1935 option and well adjust our tax calculations accordingly. If your effective tax rate is around 25 then that would be like subtracting 2 from the 8 so youd take the hourly earnings add a zero behind it then multiply by 6. The Universal Living Wage is dynamic in the purest sense of the word.

State minimum wages are determined based on the posted value of the minimum wage as of January one of the coming year National Conference of State Legislatures 2019. The formula of calculating annual salary and hourly wage is as follow. More information about the calculations performed is available on the about page.

This calculator will help hourly workers decipher their paycheck. More information about the calculations performed is available on the about page. We hope you find our tax calculator and tools useful.

What is the hourly minimum wage in Ontario. Gross Salary Wages Salaries. 1500 per week 40 hours per week 3750 per hour.

Data are updated annually in the first quarter of the new year. What is the average annual salary in Ontario. The following table lists the effective pre-tax hourly wage associated for various biweekly incomes across 40 50-hour work weeks.

What is the US minimum wage. See where that hard-earned money goes - with UK income tax National Insurance student loan and pension deductions. Please ask us if you would like to see any new calculators added here.

It is designed to show what salary a full time minimum wage worker would need to be. Weekly paycheck to hourly rate. In 2022 the lowest minimum wage is 1181 per hour in Saskatchewan.

Calculate Sales tax US. The latest budget information from April 2022 is used to show you exactly what you need to know. Enter your hourly wage and hours worked per week to see your monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan.

Annual salary calculator tool compared to the minimum wage in Ontario for 2022. Monthly Salary Annual. Post a Job Use Employer Services to easily post your job.

Sales Tax States to calculate sales tax of US States city and zip code. FUTA stands for the Federal Unemployment Tax Act. If you earn 45000 a year then after your taxes and national insurance you will take home 34217 a year or 2851 per month as a net salary.

See where that hard-earned money goes - with Federal Income Tax Social Security and other deductions. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. Daily wage to hourly rate.

If youre paid an hourly wage of 18 per hour your annual salary will equate to 37440 your monthly salary will be 3120 and your weekly pay will be 720. Take a look at our handy tax calculator and tools designed to help small business and rental property owners with GST income tax and hourly rates. No more than 30 of a persons gross income should be spent on housing.

Hourly rates weekly pay and bonuses are also catered for. The state minimum wage is the same for all individuals regardless of how many dependents they may have. Calculate the FUTA Tax.

The hourly minimum wage in Ontario is 1500. The tool helps individuals communities and employers determine a local wage rate that allows residents to meet minimum standards of living. Annual salary to hourly wage 50000 per year 52 weeks 40 hours per week 2404 per hour.

Who We Work With. How Your Paycheck Works. Quarterly Salary Annual Salary 4.

As an employer you also have to pay the IRS 62 of your employees salary dollar-for-dollar. Take for example a salaried worker who earns an annual gross salary of 65000 for 40 hours a week and has worked 52 weeks during the year. Monthly wage to hourly wage 5000 per month 12 52 weeks 40 hours per week 2885.

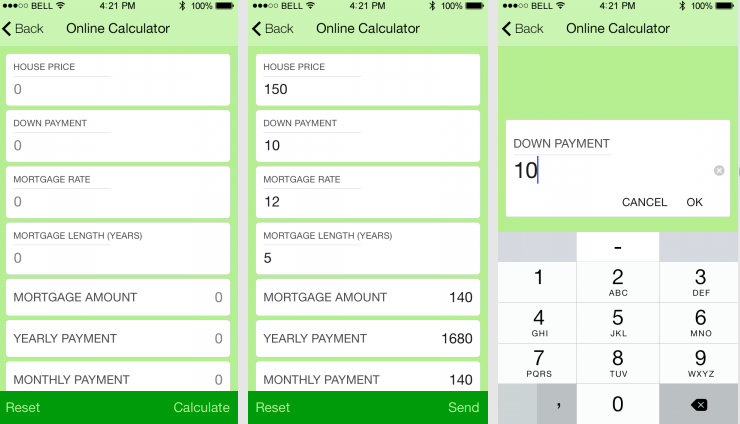

The Universal Living Wage calculator is based on the US Department of Housing and Urban Development HUD standard. See how much youll expect to take home after taxes with this free paycheck calculator. Try this online tool to find out.

Annual Salary Hourly Wage Hours per workweek 52 weeks. Nunavut has the highest at 16 per hour. Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary.

In Hand Salary Calculator Clearance 51 Off Www Quadrantkindercentra Nl

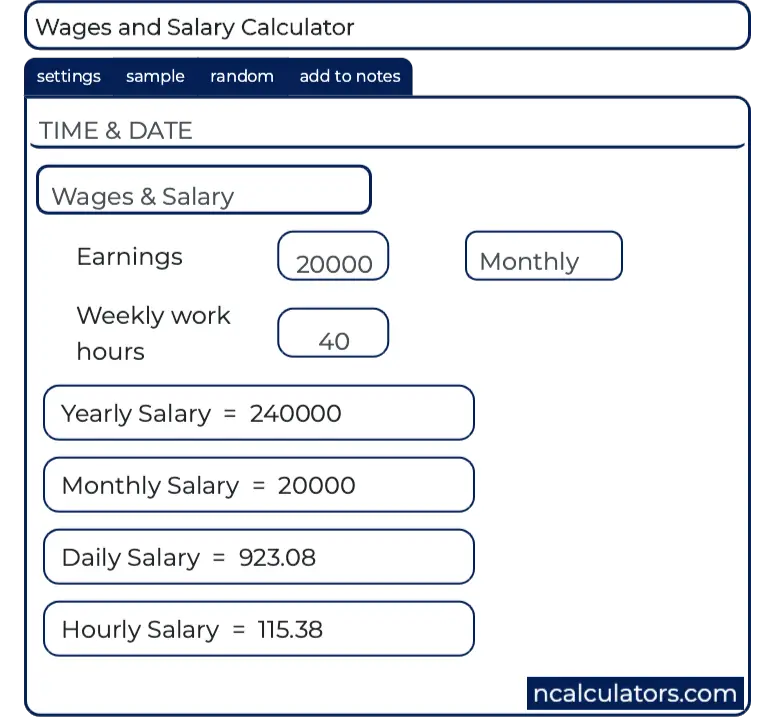

Wage Calculator Convert Salary To Hourly Pay

Annual Income Calculator Factory Sale 51 Off Www Ingeniovirtual Com

Wage Calculator With Tax Top Sellers 52 Off Www Ingeniovirtual Com

Hourly To Annual Salary Calculator Top Sellers 50 Off Www Ingeniovirtual Com

With Stubcreator Com Reliable Pay Stubs Are Generated Instantly Which Are Available For Print At The Same Time All Thanks To Its Paycheck Salary Calculator

Free Paycheck Calculator Hourly Salary Usa Dremployee

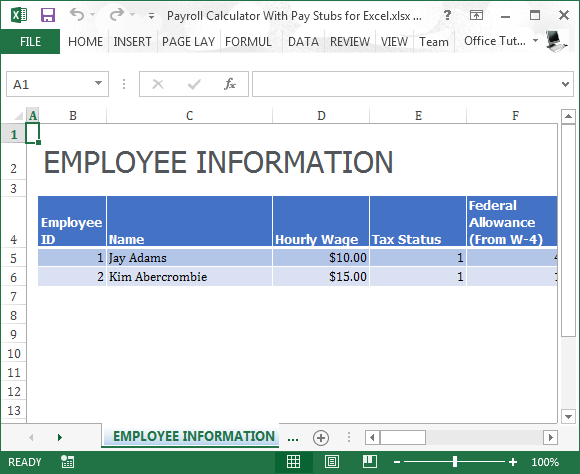

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

In Hand Salary Calculator Clearance 51 Off Www Quadrantkindercentra Nl

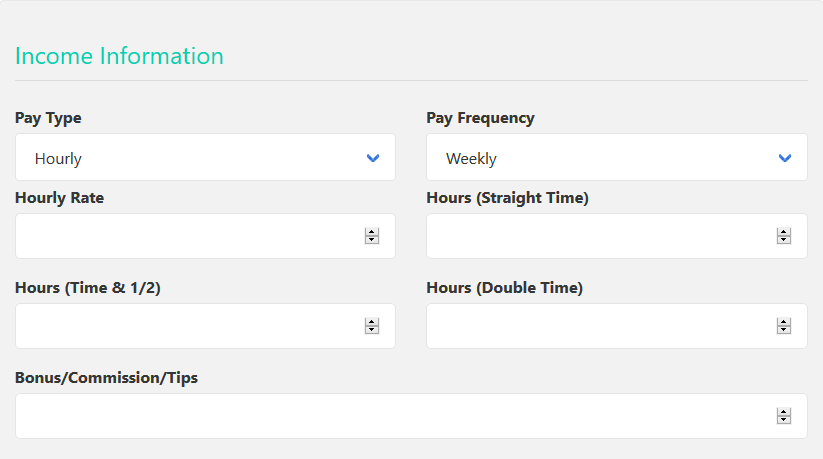

Hourly Paycheck Calculator Primepay

Adp Paycheck Calculator Best Sale 57 Off Www Quadrantkindercentra Nl

Wage Calculator With Tax Top Sellers 52 Off Www Ingeniovirtual Com

How To Calculate Taxes On Payroll Sale 51 Off Www Quadrantkindercentra Nl

Wage Calculator With Tax Store 56 Off Www Ingeniovirtual Com

Net To Gross Calculator Online 58 Off Www Ingeniovirtual Com

How To Calculate Taxes On Payroll Sale 51 Off Www Quadrantkindercentra Nl

Adp Paycheck Calculator Best Sale 57 Off Www Quadrantkindercentra Nl